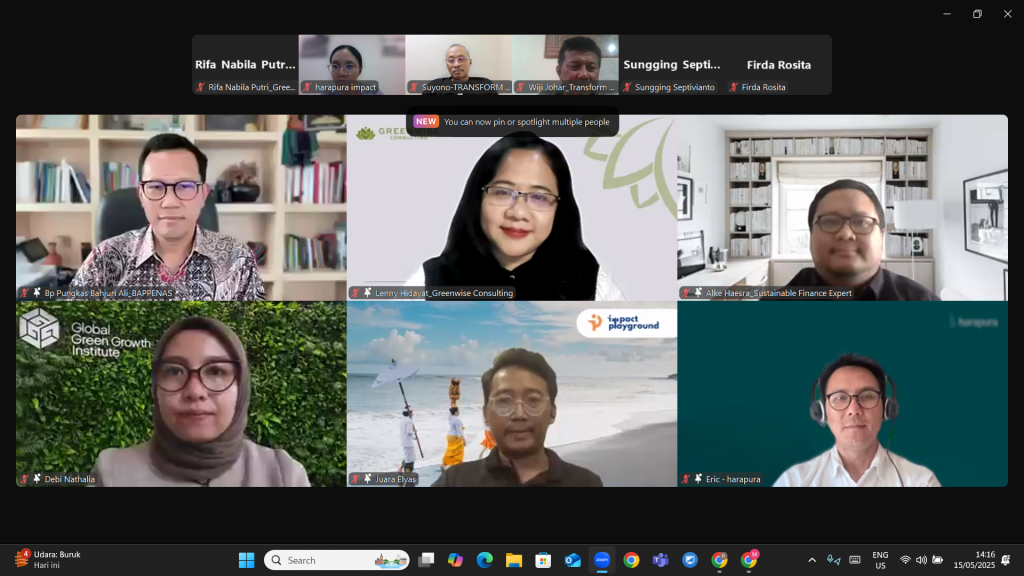

Jakarta, May 15, 2025 – Harapura Impact and Impact Playground held a webinar titled “Making Climate Funds Work for Indonesia’s Climate Innovators.” The webinar explored how climate innovators in Indonesia can more effectively access climate finance, understand the available funding mechanisms, and learn about the challenges and best practices in obtaining such funding. The forum was held online via Zoom and attended by over 45 participants from various backgrounds, including startups, NGOs, and local innovators.

Pungkas Bahjuri Ali, Head of the SDGs National Secretariat from the Ministry of Development Planning, joined other experts including Lenny Hidayat, Founder and Partner of Greenwise Consulting, Alke Haesra as Sustainable Finance Specialist at Prospera, Debi Nathalia as Senior Officer for Sustainable Finance at the Global Green Growth Institute, and Eric Natanael (Board Member of Harapura) to share insights on overcoming financial barriers and mobilizing resources at scale for climate solutions.

The webinar served as a platform to identify obstacles faced by local climate leaders, such as bureaucracy, compliance requirements, and risks encountered by investors. Additionally, the forum provided guidance on preparing fundable projects and emphasized the importance of collaboration between funders, policymakers, and climate innovators to promote strategic and sustainable partnerships.

“Climate finance is no longer optional but a risk mitigation strategy and a long-term development resilience approach aligned with SDG 13,” said Mr. Pungkas. “Climate risks include not only physical hazards like floods and droughts but also transition risks such as policy changes and technological disruptions, all of which directly impact on the financial sector.” He then added the need of green investing in Indonesia, “In total, the energy, land, agriculture, waste and garbage sectors in Indonesia require green investments of around 4.8 trillion rupiahs in 2045.”

Lenny Hidayat, Founder and Partner of Greenwise Consulting, also participated as a speaker with the topic Potential Access to Impact Blended Finance. In her presentation, Lenny highlighted Indonesia’s great potential to access climate finance, particularly through climate blended finance schemes and impact investing. “Globally, there are over 80 blended finance schemes, but only a small portion are truly operating in Indonesia, and most investments are still dominated by the private sector,” Lenny said.

She also pointed out ongoing challenges such as market failures, price barriers, and limited investors at early to mid-stages. “Impact initiatives, especially from social sectors, startups, and MSMEs, often struggle to find the right funding. Therefore, the role of investors who can blend various financing instruments to bridge these gaps is essential,” she added. She also mentioned the need to enhance the climate capacity and core skills, good corporate governance, resource mobilization, and environmental technologies to address gaps in accessing impact investments.

Based on Greenwise Consulting’s experience, Lenny emphasized that these approaches are critical for driving the growth of impact projects, particularly in the climate sector. For companies, financial institutions, and organizations looking to enhance climate core skills, pipeline development, and environmental technologies for sustainable projects, Greenwise Consulting is ready to be your strategic partner in designing innovative and impactful financing solutions. Contact us at www.greenwise.co.id for consultation and further discussion tailored to your specific needs.